Hello all,

Well, jumped into a put at 577 6/8 at 12.28 EST... for 32.1 cents... current reached 580 as I write... Option currently going for 30.5 cents... plan on holding overnight and through the report... will accept profits quickly as I may provide an op to go long as the weather doesn't look good for any more planting...

Think the trade is expecting 85-90%

I am looking for 91%

Also will be looking for good numbers on emergence...

Good Luck All and May The Force Be With You...

Tuesday, May 28, 2013

Wednesday, May 22, 2013

Corn 5/22

Welp,

Didn't take profits after the progress report and exited today for an 8 cent loss on the trade... Bought (1) Sept 550 Put for 30.3 cents at 558 just before the pop to 560 at 11:05...

Looking for 560 to hold as resistance, however the ethanol report came out and were bullish... more production less inventory... that would explain the 16 cent pop in corn today... I guess I should have seen that coming...

Didn't take profits after the progress report and exited today for an 8 cent loss on the trade... Bought (1) Sept 550 Put for 30.3 cents at 558 just before the pop to 560 at 11:05...

Looking for 560 to hold as resistance, however the ethanol report came out and were bullish... more production less inventory... that would explain the 16 cent pop in corn today... I guess I should have seen that coming...

Monday, May 20, 2013

The Corn Progress Trade

Welp, Here we are again... nothing to do but wait... nervous must admit...

here's the trade...

May The Force Be With Me....

Corn 5/20

Afternoon all,

Exited my single July Put option this morning off the pit open scare... Gave em $100, but then entered a Dec 500 Put at 518 for 31.5 and later entered a Sept 520 Put at 553 for 20.0 cents...

Expecting both contracts to trail (slowly) downward ahead of the report. I will be holding both until tomorrow or at the electronic open tonight... if I can get a decent spread...

Currently a penny off the lows... and holding... as of 12:34

Exited my single July Put option this morning off the pit open scare... Gave em $100, but then entered a Dec 500 Put at 518 for 31.5 and later entered a Sept 520 Put at 553 for 20.0 cents...

Expecting both contracts to trail (slowly) downward ahead of the report. I will be holding both until tomorrow or at the electronic open tonight... if I can get a decent spread...

Currently a penny off the lows... and holding... as of 12:34

Friday, May 17, 2013

Corn 5/17

Good Friday Afternoon all,

Today was an interesting day on the ol corn market... I went in holding naked puts up a few pennies, at about 10:30 the market moved against me, but not before reaching a low, which I shoulda exited on.. Instead it started up, broke through my channel, which was my exit signal...

I was able to exit at 644 for +1.44 x 3... She then ran up and touched one of my many fib lines which told me to my short...

I bought 1 July 650 at 652 2/8 for 20.7

She then continued up and reached for 655..again a fib on one of my charts.. at which I tried to buy another one at 18.7...but no fill...

The rest of the day she traded sideways to down for a very unexciting day..

I was happy to exit with a small profit, but left nearly $300 on the table...

At the close, I tried to exit for a penny profit and set my limit at 21.7... No fill... I was the Ask at the bottom and that only lasted a second... I then replaced my order several time to try and get filled, but it was an last minute pop, which has left me holding 1 July put over the weekend..

I do not like holding options over the weekend.... and with the weather acting up... I may have screwed up...

The good news... I reduced my exposure to the market by only buying 1 put, vs my earlier position of 3... this allows me alittle comfort as my potential losses are cut by a 3rd... Indeed, the good news is that I did not hesitate and exited my positions while they were still profitable... So... thats the update... got the crop progress report on Monday after the close and with any luck I will gain enough with this position as to not add...I am getting in alittle over my head as we still have not direction in this market... as that is the main reason I am happy to only be holding 1 in lieu of 3...

The plan for next week... look for a re-rest of highs prior to the report...if we get it add 1 position before the close and hold ...

Today was an interesting day on the ol corn market... I went in holding naked puts up a few pennies, at about 10:30 the market moved against me, but not before reaching a low, which I shoulda exited on.. Instead it started up, broke through my channel, which was my exit signal...

I was able to exit at 644 for +1.44 x 3... She then ran up and touched one of my many fib lines which told me to my short...

I bought 1 July 650 at 652 2/8 for 20.7

She then continued up and reached for 655..again a fib on one of my charts.. at which I tried to buy another one at 18.7...but no fill...

The rest of the day she traded sideways to down for a very unexciting day..

I was happy to exit with a small profit, but left nearly $300 on the table...

At the close, I tried to exit for a penny profit and set my limit at 21.7... No fill... I was the Ask at the bottom and that only lasted a second... I then replaced my order several time to try and get filled, but it was an last minute pop, which has left me holding 1 July put over the weekend..

I do not like holding options over the weekend.... and with the weather acting up... I may have screwed up...

The good news... I reduced my exposure to the market by only buying 1 put, vs my earlier position of 3... this allows me alittle comfort as my potential losses are cut by a 3rd... Indeed, the good news is that I did not hesitate and exited my positions while they were still profitable... So... thats the update... got the crop progress report on Monday after the close and with any luck I will gain enough with this position as to not add...I am getting in alittle over my head as we still have not direction in this market... as that is the main reason I am happy to only be holding 1 in lieu of 3...

The plan for next week... look for a re-rest of highs prior to the report...if we get it add 1 position before the close and hold ...

Thursday, May 16, 2013

Corn 5/16

Good day all,

Hope that the day treated you all well...

I would re post my charts for yesterday, but accidentally close them without saving them...ugh... Kinda hopped up on coffee watching the market all day.. which was... a waste of time... after the initial move down...we reach 640 2/8 only to start the slow grind up for the rest of the day... as I am now in the money... I can worry LESS... HA ! if that is possible...

Market is slow but sketchy... the weather is starting to act up with tornadoes in Texas... heard a report of and F-4..

I do not want to get caught short if this weather is not beneficial... but If you get some water down just after you plant...that gotta be good , plus the progress report comes out Monday... everyone must be thinking the same thing... big increase in progress...

IMHO, now is not the time to think about if it is gonna come up, cuz 1st you gotta get it in the ground... but I do hear chatter of emergence and we will be looking for an increase but nothing substantial until next week or the following week... that puts us in June... In June, we should start digesting the progress of emergence... I believe that will tell the tale regarding this years crop... and at that time it could be the time to go long Dec Corn...

I was able to reproduce this chart and added 2 additional "support" lines... Again, I believe that a close below 643 the 61.80% fib retracement sets us up for a test of the 23.60% fib on the most recent move.... a Break below the dark blue line and the X and the fib initiates further downward action to test the low of 612 on the July contract...

Moving forward... I tried to exit my position at the close with a limit order placed at 22 cents... No Joy... I will be looking to exit tomorrow with a profit (hopefully) and re initiate my short position Monday before the close... Good Luck and May The Force Be With You...

Hope that the day treated you all well...

I would re post my charts for yesterday, but accidentally close them without saving them...ugh... Kinda hopped up on coffee watching the market all day.. which was... a waste of time... after the initial move down...we reach 640 2/8 only to start the slow grind up for the rest of the day... as I am now in the money... I can worry LESS... HA ! if that is possible...

Market is slow but sketchy... the weather is starting to act up with tornadoes in Texas... heard a report of and F-4..

I do not want to get caught short if this weather is not beneficial... but If you get some water down just after you plant...that gotta be good , plus the progress report comes out Monday... everyone must be thinking the same thing... big increase in progress...

IMHO, now is not the time to think about if it is gonna come up, cuz 1st you gotta get it in the ground... but I do hear chatter of emergence and we will be looking for an increase but nothing substantial until next week or the following week... that puts us in June... In June, we should start digesting the progress of emergence... I believe that will tell the tale regarding this years crop... and at that time it could be the time to go long Dec Corn...

I was able to reproduce this chart and added 2 additional "support" lines... Again, I believe that a close below 643 the 61.80% fib retracement sets us up for a test of the 23.60% fib on the most recent move.... a Break below the dark blue line and the X and the fib initiates further downward action to test the low of 612 on the July contract...

Moving forward... I tried to exit my position at the close with a limit order placed at 22 cents... No Joy... I will be looking to exit tomorrow with a profit (hopefully) and re initiate my short position Monday before the close... Good Luck and May The Force Be With You...

Wednesday, May 15, 2013

My Beloved Corn - 4/15

Good Day all,

As you can see, I have resigned from trading the SPY except for my long positions on UVXY, SPUX & FAZ...

I am now fully engaged in this years crop, more specifically ... corn...

I have posted these on Stocktwits & twitter, but here they are again so that you can see them all...

The above chart is a long term continuous corn chart indicating a long term bull channel, with a short term bear channel or flag...

The above chart is the same chart only zoomed in with my short entries...

I know that the 2 may seem to indicate different things, but my time frames are short in the short term with old crop corn due to cost, looking for an entry to go long with new crop corn at what I am considering my buy area between the 2 fib lines between 624 & 615 on the continuous contract... I will need to see where that lands for Dec corn, but am not ready to go long yet...

I am looking for a short term retracement due to good weather and farmers are rollin" ... I consider this Hope...Hope that they get it all in, Hope that it take, Hope that it emerges... Once the planting is done, I will be looking for emergence on the progress reports. With the lack of sub soil moisture, I believe that we will not get the same push that we did last year... However, with the recent weather showing some rain over the weekend, it could be just what the Doc ordered and we could see this head towards my buy level...

In summary, I am short old crop due to hopes of new crop, when this wears off, I will be looking to go long, through what I think will be another miserable growing year... Wishing all of my Framer Friends the best of luck...

As you can see, I have resigned from trading the SPY except for my long positions on UVXY, SPUX & FAZ...

I am now fully engaged in this years crop, more specifically ... corn...

I have posted these on Stocktwits & twitter, but here they are again so that you can see them all...

The above chart is a long term continuous corn chart indicating a long term bull channel, with a short term bear channel or flag...

The above chart is the same chart only zoomed in with my short entries...

I know that the 2 may seem to indicate different things, but my time frames are short in the short term with old crop corn due to cost, looking for an entry to go long with new crop corn at what I am considering my buy area between the 2 fib lines between 624 & 615 on the continuous contract... I will need to see where that lands for Dec corn, but am not ready to go long yet...

I am looking for a short term retracement due to good weather and farmers are rollin" ... I consider this Hope...Hope that they get it all in, Hope that it take, Hope that it emerges... Once the planting is done, I will be looking for emergence on the progress reports. With the lack of sub soil moisture, I believe that we will not get the same push that we did last year... However, with the recent weather showing some rain over the weekend, it could be just what the Doc ordered and we could see this head towards my buy level...

In summary, I am short old crop due to hopes of new crop, when this wears off, I will be looking to go long, through what I think will be another miserable growing year... Wishing all of my Framer Friends the best of luck...

Friday, May 3, 2013

SPY 5/3/13 ... Congrats to the Bulls ...

Happy Friday All,

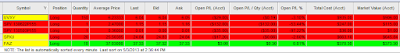

The Bulls have won !!! The Bulls have won!!! SPY breaks through 160 and powers up to near 162... (161.88) I in turn dropped the last of my acct on shares of UVXY, SPXU & FAZ... See Below

You can also see that this weeks 155 put option will expire worthless (Loss of $35.00) and I am still holding my June 22, 155 Put... Now down 53.44% ...

I have established my long term short position using these ETF's, even though I do not know alot about them... The options plays cost me a chunk... and as I can no longer purchase options on this side of the house, I figured I would find a way to put my remaining money to work. Not sure if this plan will work, but only time will tell...

I am hoping to do some homework and get back on track with school, however after missing so badly on the last spy trade... it find it difficult to even be in front of the computer... I know its not alot of money to some folks... but if that's the case, use percentages... that will show the hurt for sure...

Starting to think of a Gold play but every time I start looking at gold, something, either the cost of the options, the delta, the time... mainly the expense.. turns me off...

I am so far out of the loop on corn, that I don't know which way it up... I have some things drawn up, but we are at a time where it could go either way... will begin to track report days and potential trades coming in the future... last year, I had to wait.. think I will do the same this year...

Otherwise, its Friday... Congratulations to the Bulls of the Spy... You were right and I was wrong... Still have sometime on that June Put and nothing but time on the others... Time is now on my side, but not so much leverage...

The Bulls have won !!! The Bulls have won!!! SPY breaks through 160 and powers up to near 162... (161.88) I in turn dropped the last of my acct on shares of UVXY, SPXU & FAZ... See Below

You can also see that this weeks 155 put option will expire worthless (Loss of $35.00) and I am still holding my June 22, 155 Put... Now down 53.44% ...

I have established my long term short position using these ETF's, even though I do not know alot about them... The options plays cost me a chunk... and as I can no longer purchase options on this side of the house, I figured I would find a way to put my remaining money to work. Not sure if this plan will work, but only time will tell...

I am hoping to do some homework and get back on track with school, however after missing so badly on the last spy trade... it find it difficult to even be in front of the computer... I know its not alot of money to some folks... but if that's the case, use percentages... that will show the hurt for sure...

Starting to think of a Gold play but every time I start looking at gold, something, either the cost of the options, the delta, the time... mainly the expense.. turns me off...

I am so far out of the loop on corn, that I don't know which way it up... I have some things drawn up, but we are at a time where it could go either way... will begin to track report days and potential trades coming in the future... last year, I had to wait.. think I will do the same this year...

Otherwise, its Friday... Congratulations to the Bulls of the Spy... You were right and I was wrong... Still have sometime on that June Put and nothing but time on the others... Time is now on my side, but not so much leverage...

Subscribe to:

Posts (Atom)