Wednesday, June 12, 2013

Corn 6/12 results

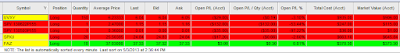

So, just prior to the release I purchase another 610 Dec call, this time for 18.7 cents... the report came out and down she went...at the low, I saw an ask of 11 cents but bids remained at 18... then after a minute or two they settled into their current value of about 16 cent... this leaves me down 2.5 on the last one and 4.5 on the 1st.... ouch... still holding as I have plenty of time and expect to see the market return to trading the weather... Need a little love to get back to even... should be able to salvage this trade...

Corn 6/12

Yo,

Bought a Dec 610 call option at the close yesterday for 20.5 cents at 550... at 9:21 Corn is setting to open down 5 cent to 542... that sucks... got in on this trade too early ... delta on the option is 30%... Looking for the report to be Bullish and continued bad weather doesn't help...

Until 11:00...

May The Force Be With You...

Bought a Dec 610 call option at the close yesterday for 20.5 cents at 550... at 9:21 Corn is setting to open down 5 cent to 542... that sucks... got in on this trade too early ... delta on the option is 30%... Looking for the report to be Bullish and continued bad weather doesn't help...

Until 11:00...

May The Force Be With You...

Tuesday, May 28, 2013

Corn 5/28

Hello all,

Well, jumped into a put at 577 6/8 at 12.28 EST... for 32.1 cents... current reached 580 as I write... Option currently going for 30.5 cents... plan on holding overnight and through the report... will accept profits quickly as I may provide an op to go long as the weather doesn't look good for any more planting...

Think the trade is expecting 85-90%

I am looking for 91%

Also will be looking for good numbers on emergence...

Good Luck All and May The Force Be With You...

Well, jumped into a put at 577 6/8 at 12.28 EST... for 32.1 cents... current reached 580 as I write... Option currently going for 30.5 cents... plan on holding overnight and through the report... will accept profits quickly as I may provide an op to go long as the weather doesn't look good for any more planting...

Think the trade is expecting 85-90%

I am looking for 91%

Also will be looking for good numbers on emergence...

Good Luck All and May The Force Be With You...

Wednesday, May 22, 2013

Corn 5/22

Welp,

Didn't take profits after the progress report and exited today for an 8 cent loss on the trade... Bought (1) Sept 550 Put for 30.3 cents at 558 just before the pop to 560 at 11:05...

Looking for 560 to hold as resistance, however the ethanol report came out and were bullish... more production less inventory... that would explain the 16 cent pop in corn today... I guess I should have seen that coming...

Didn't take profits after the progress report and exited today for an 8 cent loss on the trade... Bought (1) Sept 550 Put for 30.3 cents at 558 just before the pop to 560 at 11:05...

Looking for 560 to hold as resistance, however the ethanol report came out and were bullish... more production less inventory... that would explain the 16 cent pop in corn today... I guess I should have seen that coming...

Monday, May 20, 2013

The Corn Progress Trade

Welp, Here we are again... nothing to do but wait... nervous must admit...

here's the trade...

May The Force Be With Me....

Corn 5/20

Afternoon all,

Exited my single July Put option this morning off the pit open scare... Gave em $100, but then entered a Dec 500 Put at 518 for 31.5 and later entered a Sept 520 Put at 553 for 20.0 cents...

Expecting both contracts to trail (slowly) downward ahead of the report. I will be holding both until tomorrow or at the electronic open tonight... if I can get a decent spread...

Currently a penny off the lows... and holding... as of 12:34

Exited my single July Put option this morning off the pit open scare... Gave em $100, but then entered a Dec 500 Put at 518 for 31.5 and later entered a Sept 520 Put at 553 for 20.0 cents...

Expecting both contracts to trail (slowly) downward ahead of the report. I will be holding both until tomorrow or at the electronic open tonight... if I can get a decent spread...

Currently a penny off the lows... and holding... as of 12:34

Friday, May 17, 2013

Corn 5/17

Good Friday Afternoon all,

Today was an interesting day on the ol corn market... I went in holding naked puts up a few pennies, at about 10:30 the market moved against me, but not before reaching a low, which I shoulda exited on.. Instead it started up, broke through my channel, which was my exit signal...

I was able to exit at 644 for +1.44 x 3... She then ran up and touched one of my many fib lines which told me to my short...

I bought 1 July 650 at 652 2/8 for 20.7

She then continued up and reached for 655..again a fib on one of my charts.. at which I tried to buy another one at 18.7...but no fill...

The rest of the day she traded sideways to down for a very unexciting day..

I was happy to exit with a small profit, but left nearly $300 on the table...

At the close, I tried to exit for a penny profit and set my limit at 21.7... No fill... I was the Ask at the bottom and that only lasted a second... I then replaced my order several time to try and get filled, but it was an last minute pop, which has left me holding 1 July put over the weekend..

I do not like holding options over the weekend.... and with the weather acting up... I may have screwed up...

The good news... I reduced my exposure to the market by only buying 1 put, vs my earlier position of 3... this allows me alittle comfort as my potential losses are cut by a 3rd... Indeed, the good news is that I did not hesitate and exited my positions while they were still profitable... So... thats the update... got the crop progress report on Monday after the close and with any luck I will gain enough with this position as to not add...I am getting in alittle over my head as we still have not direction in this market... as that is the main reason I am happy to only be holding 1 in lieu of 3...

The plan for next week... look for a re-rest of highs prior to the report...if we get it add 1 position before the close and hold ...

Today was an interesting day on the ol corn market... I went in holding naked puts up a few pennies, at about 10:30 the market moved against me, but not before reaching a low, which I shoulda exited on.. Instead it started up, broke through my channel, which was my exit signal...

I was able to exit at 644 for +1.44 x 3... She then ran up and touched one of my many fib lines which told me to my short...

I bought 1 July 650 at 652 2/8 for 20.7

She then continued up and reached for 655..again a fib on one of my charts.. at which I tried to buy another one at 18.7...but no fill...

The rest of the day she traded sideways to down for a very unexciting day..

I was happy to exit with a small profit, but left nearly $300 on the table...

At the close, I tried to exit for a penny profit and set my limit at 21.7... No fill... I was the Ask at the bottom and that only lasted a second... I then replaced my order several time to try and get filled, but it was an last minute pop, which has left me holding 1 July put over the weekend..

I do not like holding options over the weekend.... and with the weather acting up... I may have screwed up...

The good news... I reduced my exposure to the market by only buying 1 put, vs my earlier position of 3... this allows me alittle comfort as my potential losses are cut by a 3rd... Indeed, the good news is that I did not hesitate and exited my positions while they were still profitable... So... thats the update... got the crop progress report on Monday after the close and with any luck I will gain enough with this position as to not add...I am getting in alittle over my head as we still have not direction in this market... as that is the main reason I am happy to only be holding 1 in lieu of 3...

The plan for next week... look for a re-rest of highs prior to the report...if we get it add 1 position before the close and hold ...

Thursday, May 16, 2013

Corn 5/16

Good day all,

Hope that the day treated you all well...

I would re post my charts for yesterday, but accidentally close them without saving them...ugh... Kinda hopped up on coffee watching the market all day.. which was... a waste of time... after the initial move down...we reach 640 2/8 only to start the slow grind up for the rest of the day... as I am now in the money... I can worry LESS... HA ! if that is possible...

Market is slow but sketchy... the weather is starting to act up with tornadoes in Texas... heard a report of and F-4..

I do not want to get caught short if this weather is not beneficial... but If you get some water down just after you plant...that gotta be good , plus the progress report comes out Monday... everyone must be thinking the same thing... big increase in progress...

IMHO, now is not the time to think about if it is gonna come up, cuz 1st you gotta get it in the ground... but I do hear chatter of emergence and we will be looking for an increase but nothing substantial until next week or the following week... that puts us in June... In June, we should start digesting the progress of emergence... I believe that will tell the tale regarding this years crop... and at that time it could be the time to go long Dec Corn...

I was able to reproduce this chart and added 2 additional "support" lines... Again, I believe that a close below 643 the 61.80% fib retracement sets us up for a test of the 23.60% fib on the most recent move.... a Break below the dark blue line and the X and the fib initiates further downward action to test the low of 612 on the July contract...

Moving forward... I tried to exit my position at the close with a limit order placed at 22 cents... No Joy... I will be looking to exit tomorrow with a profit (hopefully) and re initiate my short position Monday before the close... Good Luck and May The Force Be With You...

Hope that the day treated you all well...

I would re post my charts for yesterday, but accidentally close them without saving them...ugh... Kinda hopped up on coffee watching the market all day.. which was... a waste of time... after the initial move down...we reach 640 2/8 only to start the slow grind up for the rest of the day... as I am now in the money... I can worry LESS... HA ! if that is possible...

Market is slow but sketchy... the weather is starting to act up with tornadoes in Texas... heard a report of and F-4..

I do not want to get caught short if this weather is not beneficial... but If you get some water down just after you plant...that gotta be good , plus the progress report comes out Monday... everyone must be thinking the same thing... big increase in progress...

IMHO, now is not the time to think about if it is gonna come up, cuz 1st you gotta get it in the ground... but I do hear chatter of emergence and we will be looking for an increase but nothing substantial until next week or the following week... that puts us in June... In June, we should start digesting the progress of emergence... I believe that will tell the tale regarding this years crop... and at that time it could be the time to go long Dec Corn...

I was able to reproduce this chart and added 2 additional "support" lines... Again, I believe that a close below 643 the 61.80% fib retracement sets us up for a test of the 23.60% fib on the most recent move.... a Break below the dark blue line and the X and the fib initiates further downward action to test the low of 612 on the July contract...

Moving forward... I tried to exit my position at the close with a limit order placed at 22 cents... No Joy... I will be looking to exit tomorrow with a profit (hopefully) and re initiate my short position Monday before the close... Good Luck and May The Force Be With You...

Wednesday, May 15, 2013

My Beloved Corn - 4/15

Good Day all,

As you can see, I have resigned from trading the SPY except for my long positions on UVXY, SPUX & FAZ...

I am now fully engaged in this years crop, more specifically ... corn...

I have posted these on Stocktwits & twitter, but here they are again so that you can see them all...

The above chart is a long term continuous corn chart indicating a long term bull channel, with a short term bear channel or flag...

The above chart is the same chart only zoomed in with my short entries...

I know that the 2 may seem to indicate different things, but my time frames are short in the short term with old crop corn due to cost, looking for an entry to go long with new crop corn at what I am considering my buy area between the 2 fib lines between 624 & 615 on the continuous contract... I will need to see where that lands for Dec corn, but am not ready to go long yet...

I am looking for a short term retracement due to good weather and farmers are rollin" ... I consider this Hope...Hope that they get it all in, Hope that it take, Hope that it emerges... Once the planting is done, I will be looking for emergence on the progress reports. With the lack of sub soil moisture, I believe that we will not get the same push that we did last year... However, with the recent weather showing some rain over the weekend, it could be just what the Doc ordered and we could see this head towards my buy level...

In summary, I am short old crop due to hopes of new crop, when this wears off, I will be looking to go long, through what I think will be another miserable growing year... Wishing all of my Framer Friends the best of luck...

As you can see, I have resigned from trading the SPY except for my long positions on UVXY, SPUX & FAZ...

I am now fully engaged in this years crop, more specifically ... corn...

I have posted these on Stocktwits & twitter, but here they are again so that you can see them all...

The above chart is a long term continuous corn chart indicating a long term bull channel, with a short term bear channel or flag...

The above chart is the same chart only zoomed in with my short entries...

I know that the 2 may seem to indicate different things, but my time frames are short in the short term with old crop corn due to cost, looking for an entry to go long with new crop corn at what I am considering my buy area between the 2 fib lines between 624 & 615 on the continuous contract... I will need to see where that lands for Dec corn, but am not ready to go long yet...

I am looking for a short term retracement due to good weather and farmers are rollin" ... I consider this Hope...Hope that they get it all in, Hope that it take, Hope that it emerges... Once the planting is done, I will be looking for emergence on the progress reports. With the lack of sub soil moisture, I believe that we will not get the same push that we did last year... However, with the recent weather showing some rain over the weekend, it could be just what the Doc ordered and we could see this head towards my buy level...

In summary, I am short old crop due to hopes of new crop, when this wears off, I will be looking to go long, through what I think will be another miserable growing year... Wishing all of my Framer Friends the best of luck...

Friday, May 3, 2013

SPY 5/3/13 ... Congrats to the Bulls ...

Happy Friday All,

The Bulls have won !!! The Bulls have won!!! SPY breaks through 160 and powers up to near 162... (161.88) I in turn dropped the last of my acct on shares of UVXY, SPXU & FAZ... See Below

You can also see that this weeks 155 put option will expire worthless (Loss of $35.00) and I am still holding my June 22, 155 Put... Now down 53.44% ...

I have established my long term short position using these ETF's, even though I do not know alot about them... The options plays cost me a chunk... and as I can no longer purchase options on this side of the house, I figured I would find a way to put my remaining money to work. Not sure if this plan will work, but only time will tell...

I am hoping to do some homework and get back on track with school, however after missing so badly on the last spy trade... it find it difficult to even be in front of the computer... I know its not alot of money to some folks... but if that's the case, use percentages... that will show the hurt for sure...

Starting to think of a Gold play but every time I start looking at gold, something, either the cost of the options, the delta, the time... mainly the expense.. turns me off...

I am so far out of the loop on corn, that I don't know which way it up... I have some things drawn up, but we are at a time where it could go either way... will begin to track report days and potential trades coming in the future... last year, I had to wait.. think I will do the same this year...

Otherwise, its Friday... Congratulations to the Bulls of the Spy... You were right and I was wrong... Still have sometime on that June Put and nothing but time on the others... Time is now on my side, but not so much leverage...

The Bulls have won !!! The Bulls have won!!! SPY breaks through 160 and powers up to near 162... (161.88) I in turn dropped the last of my acct on shares of UVXY, SPXU & FAZ... See Below

You can also see that this weeks 155 put option will expire worthless (Loss of $35.00) and I am still holding my June 22, 155 Put... Now down 53.44% ...

I have established my long term short position using these ETF's, even though I do not know alot about them... The options plays cost me a chunk... and as I can no longer purchase options on this side of the house, I figured I would find a way to put my remaining money to work. Not sure if this plan will work, but only time will tell...

I am hoping to do some homework and get back on track with school, however after missing so badly on the last spy trade... it find it difficult to even be in front of the computer... I know its not alot of money to some folks... but if that's the case, use percentages... that will show the hurt for sure...

Starting to think of a Gold play but every time I start looking at gold, something, either the cost of the options, the delta, the time... mainly the expense.. turns me off...

I am so far out of the loop on corn, that I don't know which way it up... I have some things drawn up, but we are at a time where it could go either way... will begin to track report days and potential trades coming in the future... last year, I had to wait.. think I will do the same this year...

Otherwise, its Friday... Congratulations to the Bulls of the Spy... You were right and I was wrong... Still have sometime on that June Put and nothing but time on the others... Time is now on my side, but not so much leverage...

Tuesday, April 30, 2013

Re-Grouping 4/30/13

Afternoon All,

Last Friday 60 of my weekly options expired worthless... Total loss of $1,600.00 ... Not a good trade... chased it all the way up,looking for some kind of correction... but there was none. Actually, I was looking for a Head & Shoulders Pattern and once it broke that pattern, my options were toast...

I still have 2 viable options, however 1 expires this Friday and it's a 155 that I bought for $30.00 ...

I checked my June 155 Put and it is down only $70 from my entry point, however this is all I got for trading the SPY, so unless something happens... This side of the house is tapped out... I may close the acct and transfer the balance to the futures options side of the house and resume tracking my beloved corn...

Last night I considered buy a July 650 Put for 21 cents, but currently am low on courage... I did not check the last traded price, but the underlying contract was down 10 cents, so you could figure a $500 move on a $1k investment... The questions is, does it continue down...

So, here's the plan... take some time off... get some homework down... track corn and prepare for the planting/growing season...

I must alert you though, Tomorrow is May and farmers still haven't put down any corn in some areas... gonna make for some interesting trading this year... Lets hope we catch it right and make a ton... May The Force Be With You...

Last Friday 60 of my weekly options expired worthless... Total loss of $1,600.00 ... Not a good trade... chased it all the way up,looking for some kind of correction... but there was none. Actually, I was looking for a Head & Shoulders Pattern and once it broke that pattern, my options were toast...

I still have 2 viable options, however 1 expires this Friday and it's a 155 that I bought for $30.00 ...

I checked my June 155 Put and it is down only $70 from my entry point, however this is all I got for trading the SPY, so unless something happens... This side of the house is tapped out... I may close the acct and transfer the balance to the futures options side of the house and resume tracking my beloved corn...

Last night I considered buy a July 650 Put for 21 cents, but currently am low on courage... I did not check the last traded price, but the underlying contract was down 10 cents, so you could figure a $500 move on a $1k investment... The questions is, does it continue down...

So, here's the plan... take some time off... get some homework down... track corn and prepare for the planting/growing season...

I must alert you though, Tomorrow is May and farmers still haven't put down any corn in some areas... gonna make for some interesting trading this year... Lets hope we catch it right and make a ton... May The Force Be With You...

Thursday, April 18, 2013

4/18/13 SPY - Free Trade

Good afternoon folks,

Been a while since I updated the blog, been gabbing on Stocktwits.... anyway, Sold all of my April 19 155 put options for a nice profit...approx 50%... this profit covers the cost of the remaining put options that i still have... (2) April 26 157 Puts and (1) June 22 155 Put. These were doing nicely as of yesterday, and as I am afraid to do something stupid, I have not opened up the acct... SPY trying to break my magic 153.90 as I write... as i plan on holding these 3 positions overnight to see what the earnings will bring...

I am in a nice place... overall I am still down... but if I can exit this trade in the 152.xx area, I will be sitting nicely after getting killed earlier this year...

May The Force Be With You...

Been a while since I updated the blog, been gabbing on Stocktwits.... anyway, Sold all of my April 19 155 put options for a nice profit...approx 50%... this profit covers the cost of the remaining put options that i still have... (2) April 26 157 Puts and (1) June 22 155 Put. These were doing nicely as of yesterday, and as I am afraid to do something stupid, I have not opened up the acct... SPY trying to break my magic 153.90 as I write... as i plan on holding these 3 positions overnight to see what the earnings will bring...

I am in a nice place... overall I am still down... but if I can exit this trade in the 152.xx area, I will be sitting nicely after getting killed earlier this year...

May The Force Be With You...

Wednesday, April 10, 2013

4/10/13 SPY

Its been awhile, bought 9 April 20 155 puts on Monday for $95, no trading at $29... bought 5 more this morning for $36.00, also trading at $29.00... watched the market soar and bought 2 April 26 157 Puts for $101 then at 158.16 I bought 1 July 155 put for $247.00... currently down over 50% and we reached a high today, so far, of 158.38.. as I write, its at 158.31 and looks like it wants more... UGH... This market is Possessed... Good luck......at the highs... right now..ugh.. ugh... theres the pop 158.49...

Wednesday, April 3, 2013

SPY, dont even want to talk about it

Hello all,

I exited today at 155.88 for $59.00 each... was able to pull $5.00 off each option, Nice little $116.00 trade or 10%, however as I write we are trying for new lows near 155.00... left 88 pts on the table... Was Holding 28 of them and just do not have the courage to check to see what they are worth now... I know I left at least $500.00 ...

I am super frustrated that I wasn't able to hold onto the winner, and held it as a loser for over 2 days..Matter of fact, I was holding a $600 loss just yesterday.....

Anyway, I will not be trading again until I have caught up on my homework... then I will have to review my trading strategy and figure out a way to risk less and capture gains. There is no reason for me to be carrying 28 options unless I have some cash in the bank.... considering going back to smaller positions, smaller time frames... more trades... I cant continue to be locked into something and watch other opportunities go by because I am all in on something else... I enjoy the rush but until I am able to better my entry points and exit points, I can not continue to trade in this fashion... I will get burned... So, I plan on taking the next 5 days off.. maybe more... I wish you all the best of luck and let your winner run and cut the losers short...

I exited today at 155.88 for $59.00 each... was able to pull $5.00 off each option, Nice little $116.00 trade or 10%, however as I write we are trying for new lows near 155.00... left 88 pts on the table... Was Holding 28 of them and just do not have the courage to check to see what they are worth now... I know I left at least $500.00 ...

I am super frustrated that I wasn't able to hold onto the winner, and held it as a loser for over 2 days..Matter of fact, I was holding a $600 loss just yesterday.....

Anyway, I will not be trading again until I have caught up on my homework... then I will have to review my trading strategy and figure out a way to risk less and capture gains. There is no reason for me to be carrying 28 options unless I have some cash in the bank.... considering going back to smaller positions, smaller time frames... more trades... I cant continue to be locked into something and watch other opportunities go by because I am all in on something else... I enjoy the rush but until I am able to better my entry points and exit points, I can not continue to trade in this fashion... I will get burned... So, I plan on taking the next 5 days off.. maybe more... I wish you all the best of luck and let your winner run and cut the losers short...

Thursday, March 28, 2013

Corn 3/28/13 Planting Intentions Report

Good Afternoon all,

Not sure if any of these get read, but as I sit here alone after crushing that corn market, I guess this is a nice outlet...

Nailed this one this year, better than last year... I probably shoulda held my option, but as we have a 3 day weekend ... Plus I really needed a win after being chewed up and spit out early this year with Wheat... Fuckin' Wheat....ARghhh... , where was I ... oh yea, Hit a double on Corn... Looking back, Wish I woulda put more on it... but can't risk the entire acct on a trade that could have gone either way...

Now, after the affects of that trade have worn off, I look at the SPY, of which I now own 18 April 12th 154 Put Options with a DCA of $72.00 Currently trading at $66.00, which puts me down about $100.00 on the trade or 8%, Not bad considering we are at 156.38 and that's my draw down. I did see -$225 at one point... I am considering holding over the weekend, but know that they will get slaughtered by time erosion... I am betting on an EOD/EOM/EOQ sell off also known as profit taking. At 1:17 only time will tell...

May The Force Be With You...

Not sure if any of these get read, but as I sit here alone after crushing that corn market, I guess this is a nice outlet...

Nailed this one this year, better than last year... I probably shoulda held my option, but as we have a 3 day weekend ... Plus I really needed a win after being chewed up and spit out early this year with Wheat... Fuckin' Wheat....ARghhh... , where was I ... oh yea, Hit a double on Corn... Looking back, Wish I woulda put more on it... but can't risk the entire acct on a trade that could have gone either way...

Now, after the affects of that trade have worn off, I look at the SPY, of which I now own 18 April 12th 154 Put Options with a DCA of $72.00 Currently trading at $66.00, which puts me down about $100.00 on the trade or 8%, Not bad considering we are at 156.38 and that's my draw down. I did see -$225 at one point... I am considering holding over the weekend, but know that they will get slaughtered by time erosion... I am betting on an EOD/EOM/EOQ sell off also known as profit taking. At 1:17 only time will tell...

May The Force Be With You...

Wednesday, March 27, 2013

3/27/13 SPY & CORN EOD update

Afternoon all,

As of 4:00, I am up $21.00 on the SPY Puts and my additional order for 2 at $72 did Not get filled... In addition, I checked the Corn trade and as of the close at 3:00 I am up $43.00...

I failed to mention the results of my single put option buy at yesterdays close. I purchased it for $76.00 and at the open it was worth $123.00 Many folks told me to exit for a nice 50% profit, but did I listen... No, Instead I proceeded to buy at my target levels. 1st at 155.60, then again at 155.80, then again at 156.05 and finally tried at 155.20 but missed it...

I am now holding 8 puts for a DCA of $82.00, as of 4:11, last trade was $85, B/A 79/81, which would imply an $11.00 loss... Finally, like my entry for this short, just think I might be early on this as well, but I am considering end of the qtr profit taking...Cypress... and all in all the BS of this rally...

RE: Corn...

don't know what else to say except I hope I bought the right month and in the right direction... otherwise, I am gonna get my ass handed to me.. 1 naked put going into exports and planting intentions... yikes...

Good Luck All...

As of 4:00, I am up $21.00 on the SPY Puts and my additional order for 2 at $72 did Not get filled... In addition, I checked the Corn trade and as of the close at 3:00 I am up $43.00...

I failed to mention the results of my single put option buy at yesterdays close. I purchased it for $76.00 and at the open it was worth $123.00 Many folks told me to exit for a nice 50% profit, but did I listen... No, Instead I proceeded to buy at my target levels. 1st at 155.60, then again at 155.80, then again at 156.05 and finally tried at 155.20 but missed it...

I am now holding 8 puts for a DCA of $82.00, as of 4:11, last trade was $85, B/A 79/81, which would imply an $11.00 loss... Finally, like my entry for this short, just think I might be early on this as well, but I am considering end of the qtr profit taking...Cypress... and all in all the BS of this rally...

RE: Corn...

don't know what else to say except I hope I bought the right month and in the right direction... otherwise, I am gonna get my ass handed to me.. 1 naked put going into exports and planting intentions... yikes...

Good Luck All...

SPY 3/27

Afternoon all,

its 3:15 as I write, and I an holding 8 154 April 12 Puts options. In addition, I just purchased 1 July 690 Put option for 22.2 cents...

I am concerned that I have entered the corn market too early to, but I got in at 716 4/8 in the last minute before it dumped to 715... started the bidding at 220, 221, 222 hit... I am very nervous about this trade as I don't usually short the report, at least I didn't last year or the year before... I could be screwing up... However, I believe that we will see huge planting and large yields and to bring corn back to normal levels...Also think the crops are good down south. Shit, this could be a guess for I know...

Short corn at 716 this Day March 27th. (Entry $1,110.00)

Short SPY at 156.00 this Day March 27th. (Average entry of $82.00)

May The Force Be With Me !!!!

its 3:15 as I write, and I an holding 8 154 April 12 Puts options. In addition, I just purchased 1 July 690 Put option for 22.2 cents...

I am concerned that I have entered the corn market too early to, but I got in at 716 4/8 in the last minute before it dumped to 715... started the bidding at 220, 221, 222 hit... I am very nervous about this trade as I don't usually short the report, at least I didn't last year or the year before... I could be screwing up... However, I believe that we will see huge planting and large yields and to bring corn back to normal levels...Also think the crops are good down south. Shit, this could be a guess for I know...

Short corn at 716 this Day March 27th. (Entry $1,110.00)

Short SPY at 156.00 this Day March 27th. (Average entry of $82.00)

May The Force Be With Me !!!!

Monday, March 25, 2013

SPY 3/25/13

Good Monday All,

Don't know about you, but been waiting for Monday since Friday... Bought (3) Put options on Friday for $88.00, at 155.90, they last traded for $48.00 HOLY SHIT !!! that's -44% or down $135.00... My Risk was 3 x $88 or $264.00..

This was an impulse buy at the close, and I should not have done it... So to start of the week of trading, I begin down $135.00, Stupid move ....

I just accepted losses of $145.00 ... Wow, was looking for 10% and ended up giving up 55%... Decided not to trade this week as we have Easter coming up and I am just not on my game. I can not remember the last time I had a winning trade.

Need to step back and not revenge trade... get my head clear, the market will be there tomorrow...

May the Force Be with You..

Don't know about you, but been waiting for Monday since Friday... Bought (3) Put options on Friday for $88.00, at 155.90, they last traded for $48.00 HOLY SHIT !!! that's -44% or down $135.00... My Risk was 3 x $88 or $264.00..

This was an impulse buy at the close, and I should not have done it... So to start of the week of trading, I begin down $135.00, Stupid move ....

I just accepted losses of $145.00 ... Wow, was looking for 10% and ended up giving up 55%... Decided not to trade this week as we have Easter coming up and I am just not on my game. I can not remember the last time I had a winning trade.

Need to step back and not revenge trade... get my head clear, the market will be there tomorrow...

May the Force Be with You..

Wednesday, March 20, 2013

SPY 3/20/13

Good Afternoon All,

Spent the day yesterday Over leveraged with (15) April 5th 154 PUT options. Ugh... In the morning, I was down $685.00 after the open, I was up $950... Did I take it??? NO, of course not, It wasn't $1,000 yet... an hour later it was at $540, then $440... that a pop that pushed me to Break Even (B/E).. I had purchased my options for $139.00 each and sold 13 out of 15 for $140.00.

I watched a $900 gain go to shit !!!!.. It hit my levels, I should have exited with a profit... I hesitated and lost the gains.

I do have to say that I was Happy, to get back to even from being down nearly 40% on the trade. Speaking of range and volatility, I awoke this morning to my 2 remaining were down $50 each !! UGH !!! that was a 35% hit... I waited after the open and made a bad purchase of another April 5th, 154 Put for $98.00 then after Ben's Speak made another bad purchase for $88.00...

So Currently, I am holding 4 with a Dollar Cost Average (DCA) of $115.00 and as of 4;15 Last price was 105.00 down $10 each for $-40.00 ... My Delta is 36, so I will need 30pts ... so 155.10 maybe is my B/E... There is still a lot of room in my channel so some downward action will not break the bull run. I am down 8% at the close, my max loss is my premium of $461.00 ... I got the rest of this week to try to earn $200, as the price goes down my delta will increase and as it goes up, the delta will decrease... Plus as it not every penny in this acct, I am comfortable risking $250, which would put the SPY at somewhere near 156.50 or near the Most Recent High if not the All Time High... Not a Terrible place to be... Wish I woulda not held those 2 from yesterday...otherwise, this trade would be in the green...

May The Force Be With You...

Friday, March 1, 2013

SPY trade EOD

3/1/13 - Welp, watched a great trade go to shit... early in the morning, greed got the better of me and I was left wanting more... shoulda exited this morning for a nice profit, instead, let it ride for an end result of a $62.00 gain. Hay a profit is a profit... I'll take it, but I will kick myself in the ass for not taking the morning... before the bell, I grabbed (3) 150 April 5, Put options for $1.90 at 152.11... Think Monday is gonna be a blood bath and I don't wanna miss the fun...

Until Monday...

Until Monday...

Friday - SPY - 3/1/13

3/1/13 - Still holding (8) from yesterday and the SPY is at 151.04 at 9:12 EST... saw it post 150.80 and was super excited, but at 151.09 with a closing price yesterday at 151.61... Still pretty Happy... Squawk mentions more about the ATH in the Dow, than any mention of the Sequester...

I am gonna hold out for sub 151 # and look to take profits. I would much rather go into the weekend with cash in hand, than hypothetical profits that can take a turn Monday morning. Right now I can exit to earn a few bucks and balance out yesterdays fuck up...

Stocktwits is bearish and hearing 148 being thrown around, which makes me want to scale out of this position in an attempt to let the profits run...

As of this update, 9:17, no options prices are posted, looks like we will see the discovery process at its best... should be interesting...

In summary, there is no telling when I am gonna get out, but out I will be before the weekend...

Good Luck today and May the Force Be With You...

I am gonna hold out for sub 151 # and look to take profits. I would much rather go into the weekend with cash in hand, than hypothetical profits that can take a turn Monday morning. Right now I can exit to earn a few bucks and balance out yesterdays fuck up...

Stocktwits is bearish and hearing 148 being thrown around, which makes me want to scale out of this position in an attempt to let the profits run...

As of this update, 9:17, no options prices are posted, looks like we will see the discovery process at its best... should be interesting...

In summary, there is no telling when I am gonna get out, but out I will be before the weekend...

Good Luck today and May the Force Be With You...

Thursday, February 28, 2013

Current SPY Trade 2/28/13

2/28/13 - Currently, I am holding (8) April 5, 151 Put options which I paid an average of $209.00 each. I scaled in WAY to early as my entry was around 152.40 before lunch. I also purchase (8) March 152 options for $109, but at the top, I bitched out and sold those for $84 each for a $264.00 loss... I am SO Pissed!!! My Max drawdown was $178 at 152.80 on the April's and at the close the options were up $303.00. However, as I sold the others for a $264.00 loss, I am only positive $40.00 ... UGH !!! The difference between a $40 day and $600 day !!! The last trade on my 151 puts was $247.00 and that was somewhere around 151.60...

So, in Summary, I have $2k in put options on the SPY....heading into the sequester.. I just put on Mad Money to see what Jim says, but I missed 1/2... I don't know what is gonna happen tomorrow, but I see the chart and to me it says SELL... that and the Force, of course...

So, in Summary, I have $2k in put options on the SPY....heading into the sequester.. I just put on Mad Money to see what Jim says, but I missed 1/2... I don't know what is gonna happen tomorrow, but I see the chart and to me it says SELL... that and the Force, of course...

Result of wheat trade and looking forward on corn

2/28/13 - Long time no update folks, Took and ass kicking on that wheat trade and rode that bitch to nearly zero... what a disgusting ride. In February, I went long wheat and corn for a day trade an scalped a few hundred on the corn and a single on the wheat... fuckin wheat...

Right now, I am stalking corn.. HA, get it... looking to short it in the near future to hold going into the Planting Intentions report... Will provide an update on that situation as it arises... currently, corn is on the up swing, but it has hit my sell mark of 720... but as I have gotten burned before, I will wait for confirmation...

Subscribe to:

Posts (Atom)